Maryland Live Casino Tax Form

The new European data protection law requires us to inform you of the following before you use our website:

Maryland Live Casino Tax Form

- Casino revenues in Maryland are also used to fund horse racing purses, minority- and women-owned businesses, and initiatives in communities surrounding the casinos. If legislators set the tax.

- Maryland Resident Income Tax Return with Form 502B. Read PDF Viewer And/Or Browser Incompatibility if you cannot open this form. Maryland long form for full- or part-year residents claiming dependents. PV(2D) Income Tax Payment Voucher. Read PDF Viewer And/Or Browser Incompatibility if you cannot open this form.

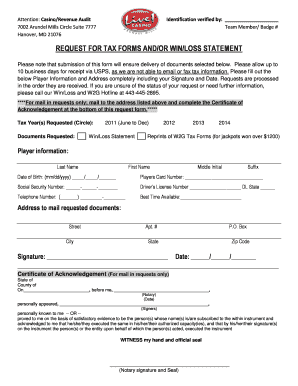

- Obtain your statement online, please DO NOT complete this form. Check box if you would like the request held & processed at end of current tax year (January 1st, 2019) Documents Requested: Win/Loss Statement Copies/Listing of Tax Forms (W-2G, 1099, 1042-S) Player information (please write legibly).

We use cookies and other technologies to customize your experience, perform analytics and deliver personalized advertising on our sites, apps and newsletters and across the Internet based on your interests. By clicking “I agree” below, you consent to the use by us and our third-party partners of cookies and data gathered from your use of our platforms. See our Privacy Policy and Third Party Partners to learn more about the use of data and your rights. You also agree to our Terms of Service.

Maryland Live Casino Tax Forms

City Street Address Days/Hours of Service Telephone; Annapolis: 1750 Forest Drive, Ste 100 Annapolis, MD 21401: Monday-Friday - 8:30 a.m.- 4:30 p.m. (Closed for lunch.